Gifting Rules 2025 Uk. Getty/metro.co.uk) enter your birthday for your free daily horoscope sent straight to your inbox! This guide examines common motivations for gifting, hmrc gift tax filing requirements, allowances that exempt tax, strategies to optimise gifting, and professional help.

Breaking Down the New Gifting Rules in 2025 YouTube, Up to £5,000 for children, up to £2,500 for grandchildren or great. This guide examines common motivations for gifting, hmrc gift tax filing requirements, allowances that exempt tax, strategies to optimise gifting, and professional help.

Mens gifting guide this festive season 2025 Artofit, After all, a sizeable gift could change a person’s life. Across the uk, giving gifts to friends, family members, or your kids is quite common.

5 Gift Rule for Christmas Why You Need To Try It Smart Family Money, If you’re worried about a potential inheritance tax bill affecting your. In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

Free White Elephant Gift Exchange Invitations, Rules, & Tips, Sponsor status and age requirement. What are the rules surrounding gifting money?

Best Gift Of 2025 Meara Jeanelle, After all, a sizeable gift could change a person’s life. What is considered a gift?

The Eight Gift Rule for Kids to Keep Christmas StressFree Rules for, Across the uk, giving gifts to friends, family members, or your kids is quite common. A gift includes property, money, and any assets.

/woman-giving-her-friend-a-wrapped-christmas-gift-926870570-5b88456c46e0fb00505f7dd6.jpg)

Rules for Gifting Money to Family for a Down Payment in 2025, Julia rosenbloom, a tax specialist at shakespeare. After all, a sizeable gift could change a person’s life.

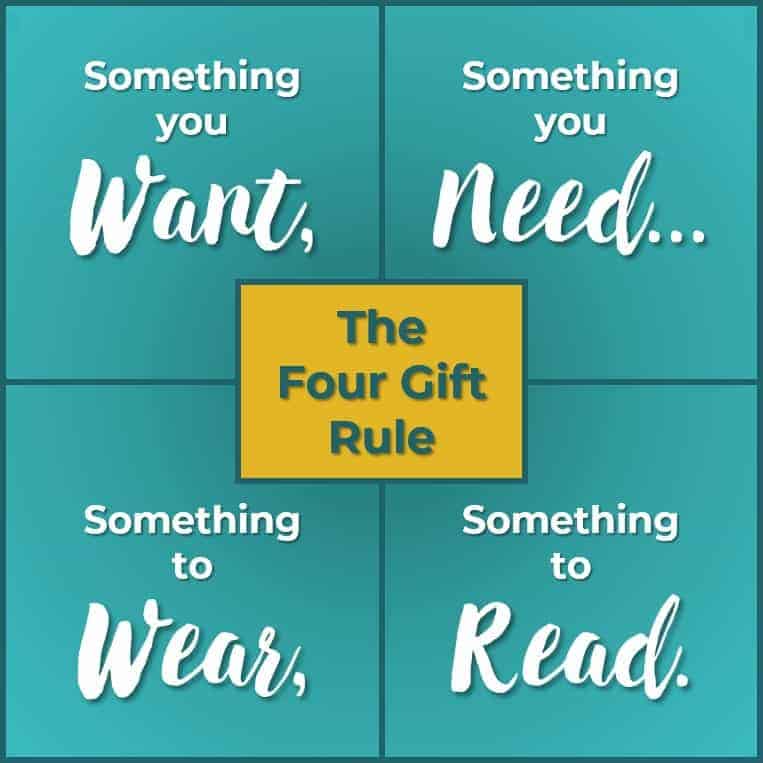

Four Gift Rule Graphic Smart Money Mamas, Gifts in other cases are taxable. In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

5 Gift Rule for Christmas The New Twist You Need to Try, In the current tax year, 2025/25, no inheritance tax is due on the first £325,000 of any estate, with 40% normally being charged on any amount above that. 50,000 per annum are exempt from tax in india.

An Introduction to Gift Rules YouTube, Can i gift my property to my children or a family. Understanding the specific rules regarding the tax deductibility of company gifts for clients and customers can empower you to make informed decisions.